It is natural for investors to search for safe investment havens with geopolitical conflicts and inflation. Some advocates of gold believe investors should allocate a significant portion of their portfolio to the asset citing the benefits of strong long-term returns and inflation protection. However, if you look at the evidence, you may start to doubt the role of gold in your portfolio.

From January 1, 1970 – January 31, 2024, gold had an annualized return of 7.79%. However, gold’s price appreciation has largely been driven by isolated, unpredictable episodes of high demand. Between January 1, 1971 – December 31, 1974, US investors were unable to directly own gold because of government restrictions. In this period, gold had an annualized return of 48.86%. Since these restrictions were lifted, gold’s annualized return between January 1, 1975 – December 31, 2023 decreased to 5.05%. 1

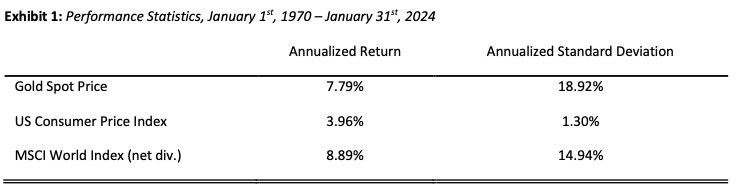

Many investors think of gold as a hedge against inflation, but the volatility of gold tends to swamp the volatility of inflation. As Exhibit 1 shows, gold has been ~14x more volatile than inflation with an annualized standard deviation of 18.92% compared to inflation’s annualized standard deviation of 1.30%. For additional context, the returns of the MSCI World Index have been less volatile than the price of gold.

Gold does not pay dividends or interest to investors. It’s only source of return is price appreciation caused by shifting supply and demand which makes gold a speculative asset. If you put gold in a vault and wait for decades, it will not produce anything and its value when you take it out of the safe will simply reflect the current spot market price. In addition, holding physical gold may incur negative cash flows because of storage, insurance, and other costs. In contrast, a stock reflects ownership in a business enterprise that seeks to generate profits and create wealth. Investors who put their capital to work in the economy expect a potential return from cash flows and appreciation.

The decision to purchase gold is often motivated by an emotional response to current events leading to abrupt shifts in allocation strategy.

1. In USD. Source of Gold Spot Price is Bloomberg. Source of US Consumer Price Index is Bureau of Labor Statistics. Source of MSCI World Index (net div.) is MSCI. MSCI data copyright MSCI 2024, all rights reserved.